With a poll showing only three in 10 Americans approve of his work on the economy, President Joe Biden said Monday that a recession will not be casting its pall over America.

“We’re not going to be in a recession, in my view,” Biden said, according to CNN. “The employment rate is still one of the lowest we’ve had in history. It’s in the 3.6 (percent) area. We still find ourselves, the people, investing.”

“My hope is we go from this rapid growth to a steady growth. And so, we’ll see some coming down. But I don’t think we’re going to — God willing — I don’t think we’re going to see a recession,” he said.

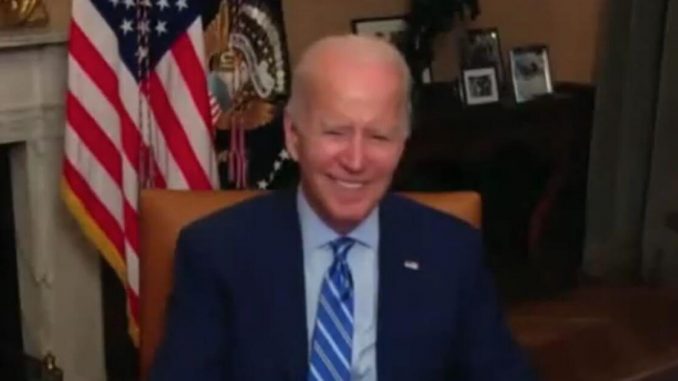

NOW – Biden: "We're not going into a recession." pic.twitter.com/KMCKN1gf7g

— Disclose.tv (@disclosetv) July 25, 2022

The White House paved the way for Biden to be correct by changing the definition of a recession. Traditionally, a recession has been loosely defined as two successive quarters of economic shrinkage, as measured by the nation’s Gross Domestic Product.

But with one quarter of shrinkage documents and a Thursday report expected, experts could denote a second one, the administration said a more “holistic” measure must be used that includes many more factors.

Regardless of the label, Americans are disgruntled.

If we weren’t in a recession, the White House wouldn’t be redefining the word “recession” on their website.

— Lauren Boebert (@laurenboebert) July 25, 2022

According to CNBC’s All-America Economic Survey, only 30 percent of Americans approve of Biden’s work on the economy. The poll of 800 people taken from July 7 to July 10 has a margin of error of plus or minus 3.5 percentage points.

A majority of those polled — 52 percent — expect the economy to get worse, and more than 60 percent expect a recession.

Kevin Hassett, head of the National Economic Council during the Trump administration, said the Biden administration should admit what everyday Americans know is real.

“We’re … kind of in recession, right? So it’s a difficult time,” Hassett said, according to CNBC.

“In this case, if I were in the White House I would not be out there sort of denying it’s a recession,” he said.

“On the labor market, we’re basically in a normal recession,” he continued. “The idea that the labor market is tight and the rest of the economy is strong, it’s not really an argument. It’s just an argument that disregards history.”

Economist Nouriel Roubini went even further, according to Bloomberg.

“There are many reasons why we are going to have a severe recession and a severe debt and financial crisis,” Roubini, chairman and chief executive officer of Roubini Macro Associates said Monday. “The idea that this is going to be short and shallow is totally delusional.”

Economist Nouriel Roubini on shallow recession calls: “There are many reasons why we are going to have a severe recession and a severe debt and financial crisis. The idea that this is going to be short and shallow is totally delusional” https://t.co/lW9yi1NMZX pic.twitter.com/h2H62RPlYe

— Bloomberg (@business) July 25, 2022

“This time, we have stagflationary negative aggregate supply shocks and debt ratios that are historically high,” Roubini continued. “In previous recessions, like the last two, we had massive monetary and fiscal easing. This time around we are going into a recession by tightening monetary policy. We have no fiscal space.”

“This time around, we have a confluence of stagflation and of a severe debt crisis,” Roubini said, adding that he believes the crisis to come could be worse than the economy of the 1970s.

Via The Western Journal.