Last Friday, the House Committee on Oversight and Reform (COAR) approved a bill as part of Congressional Democrats’ budget reconciliation efforts that would provide $350BN of direct aid to state and local governments, aid which “in most cases” is “sufficient…to cover pandemic-induced revenue losses and some if not all of the increased costs these governments face,” according to the liberal Center for Budget and Policy Priorities (CBPP).

As BofA’s Ian Rogow notes, the CBPP recently reduced their shortfall estimates for state and local governments net of federal aid and state rainy day funds to $225bn through fiscal 2022. That’s because at the beginning of the pandemic crisis, the CBPP estimated cumulative shortfalls from fiscal 2020 to fiscal 2022 for the states only of $765bn. As the data we reported over these months showed declines significantly smaller than what the CBPP projected, CBPP and others have reduced their shortfall estimates materially.

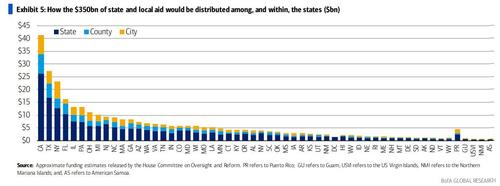

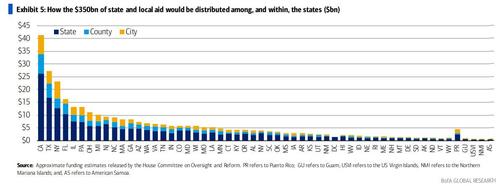

Now, the House COAR eschewed the bicameral, bipartisan funding proposal from December that Bank of America used to estimate how the $350bn in aid could be allocated. To that end, the 50 states and District of Columbia will receive – if approved by the full House and Senate – $195.3bn and local governments $130.2bn. The territories will receive $4.5bn and federally-recognized tribal governments $20bn.

These funds can be used to:

(a) respond to or mitigate the public health emergency with respect to the Coronavirus Disease 2019 (COVID–19) or its negative economic impacts,

(b) cover costs incurred as a result of such emergency,

(c) address the negative economic impacts of such emergency, or,

(d) most importantly, replace revenue that was lost, delayed, or decreased (as determined based on revenue projections for the State, Tribal Government, or territory as of January 27, 2020) as a result of such emergency.

Technically, a state or local government may also transfer funds it receives to a private nonprofit organization, a public benefit corporation involved in the transportation of passengers or cargo, a special-purpose unit of State or local government, or a multi-State entity involved in the transportation of passengers or cargo.

So what are the various US states going to get?

Of the $193.5bn for the states, $25.5bn will be divided equally, with every state receiving $500mn. The remaining $169bn will be allocated based on the states’ respective share of total unemployed workers based on a three-month average ending in December 2020. The District of Columbia will be “made whole after being treated as a territory in previous coronavirus funding Acts,” and will receive an extra $755mn of funding.

Of the $130.2bn for local governments, the COAR split it 50-50 for cities and counties. For cities, the funding will be allocated based on a modified Community Development Block Grant formula, with nearly $45.6bn going to municipalities with populations of at least 50,000 and $19.5bn going to smaller municipalities. For these smaller municipalities, their allocation will be capped at 75% of its most recent budget as of 27 January 2020. The $65.1bn for counties will be allocated by population.

Of the $4.5bn for the territories, half will be equally divided and half will be allocated based on population; for the $19bn of aid for tribal governments, $1bn will be divided equally and $19bn will be allocated as the Secretary of the Treasury determines.

Some notable highlights here:

- California – which is expecting a $26bn general fund windfall for its upcoming budget session – is estimated to receive $26.3bn of funding, and its local governments $14.9bn.

- New York State – for which the governor requested $15bn of additional aid – would receive $12.7bn, while its local governments would receive $10.6bn, including Suffolk County which floated a potential sale of notes to the Fed under the Municipal Liquidity Facility, which will receive $289mn.

- Illinois – which sold two series of notes of the Fed totaling $3.2bn – will receive $7.5bn, or about 2.5x the projected fiscal 2022 budget deficit that the governor plans to close through cutting spending and closing corporate tax loopholes (yet, it also has an unpaid bill backlog of $5.2bn as of 17 February).

- Puerto Rico, where General Fund revenues are up 11% versus adopted liquidity plans through 5 February – will receive $2.5bn directly, and its local governments $1.9bn.

Separately, local governments to highlight include:

- $1.2bn for the City of Los Angeles and $2.0bn for Los Angeles County,

- $601mn for the City and County of San Francisco

- $5.6bn for New York City (the city and its counties).

Of course, this is just a small part: aid set to flow to state and local governments is not limited to the $350bn in direct aid. In fact, it also provides $170bn for K-12 and higher education, along with billions more for vaccine distribution and virus testing, public housing, and so on. Suffice to say, as even BofA admits, “these amounts are significant.”

Finally, here is a visual breakdown of how much of the $350BN every states will receive broken down by state, county and city aid:

Via Zero Hedge